Throughout my life I’ve seen credit scores make or break dreams. It can be the deciding factor to whether or not you can afford your college tuition at your dream school, pay for that perfect house in the PERFECT neighborhood you want to live in, start up that business that you know will change the world, or buy the ring you want to give to your dream spouse.

These 10 ways below are some ways that may help increase your credit score AND odds to live the life you desire. You don’t need to know the exact formula of a credit score, but by effectively managing your life habits and the debt you take on, you will have the right tools to be successful. This information shouldn’t be seen a replacement for an experienced financial advisor when you are really in trouble, but this could help you when your next life purchase is around the corner.

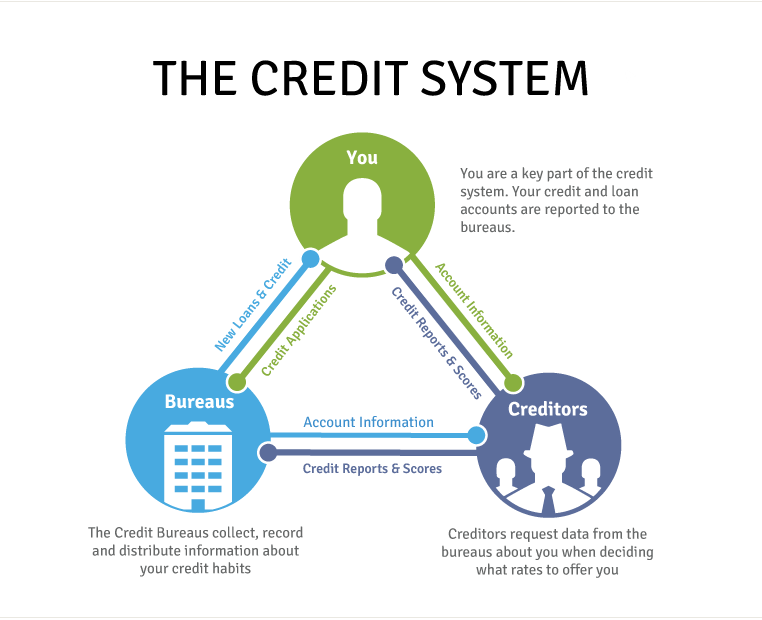

1. Analyze the terrain (The Credit System)

Always know the terrain before you starting anything. A credit reporting system is made up of three main players: consumers, credit bureaus and financial companies. The 3 Credit Bureaus are TransUnion, Equifax, and Experian (source: credit.com). Use the chart below to see how the game works. Half of the battle in creativity is knowing the rules. I like this quote from Dalai Lama XIV “Know the rules well, so you can break them effectively.” And by break, he means bend to your advantage (I’m not advocating breaking the law but rather, using the laws to your benefit when playing within their boundaries).

Half of the battle in creativity is knowing the rules.

2. The Credit Pie

“What gets measured, gets managed.” – Peter Drucker

A credit score position is based on five main components called the FICO Credit Scores, provided by Granite Capital:

- 30% Available credit: Credit limit minus the amount you owe for each account.

- 10% Number of inquiries: records of inquiries logged when you apply for credit.

- 10% Type of credit: student loans, installment loans, revolving accounts, mortgages, etc.

- 35% Payment history: the record of your on-time and late payments.

- 15% Length of history: the time elapsed since each account was opened.

Related: 50 Inspiring Leadership and Life Quotes That Will Get you Going

3. Clear The Clutter

Statistics show over 80 percent of consumer’s credit reports have errors. This kills many credit scores. In order to be creative, you need to understand the errors and the risk of them being there unchecked, and then removing them through the proper means.

Take advantage of the annual free credit reports all the three major creditors provide. Again they are Experian, Equifax and TransUnion. The government mandates that they each give you 1 free credit score each year. Take full advantage of it on www.annualcreditreport.com. You don’t need to use all three at one time so you can spread them out throughout the year. This should be the only “free” source that you use. If you want to get additional reports, you need to pay a nominal fee through each credit bureau for each report.

4. Limit your debt

Certain types of debt are can be beneficial. Some examples would be buying a house or college tuition.

This kind of debt should be seen as an investment in your life. However, the amount of debt you take on and how much the interest rates are should dictate your decisions (along with it being a good investment in the first place).. If you don’t think you will be able to pay off the debt in a reasonable amount of time, then don’t take it on in the first place.

Make sure to pay off your debts quickly by paying more than the minimum payment so the interest charges won’t drown you. Credit cards have a higher interest rate than other types of loans so make sure to pay off the balance every month and don’t spend beyond your means. Start looking at cutting out unnecessary expenditures and watch your debt go down and your credit score slowly climb to where it should be.

5. Card Discipline

“Always have an intent in all of your actions. They make your actions more meaningful.” -Le Mada

Now that we know how the game works, let’s start playing smart.

Do whatever it takes to decrease the probability of finding yourself in major problems, like debt. When you get a credit card, it isn’t a blank check to spend, spend, spend. You are playing with your own money and not the credit card company’s. Use your credit card wisely. Just because you have a $5000 credit limit, that doesn’t mean you should max it out.

Like I said previously, your revolving debt to credit limit ratio affects your credit score. Keep that in mind when you make a purchase. When you buy something, it should be seen as an investment rather than an expense. If the value of your investment is smaller than the cost of the purchase, you are paying for an expense rather than something that benefits you. It is better to weigh out your options before you make an impulse buy. Hold yourself accountable and make sure that other people do too.

You will need to adopt certain lifestyle and habits that can help you lower your spending.

6. Accountability

Not paying your bills on time is one of the most common reasons credits scores are hitting the floor for so many people. A good rule of thumb (for loans and credit cards): pay AT LEAST the minimum BEFORE every due date. By paying more than your minimum payment, you will save a lot on interest charges. So limit your debt.

A simple way to stay on track is to use an accountability partner, your calendar, or an app to remind yourself your bill is due. Rely on your accountability partner and backup with the latter options. Being accountable to another person is one the most ancient ways to be productive and on time. This one motivating factor will fiscally transform you into a fiscally responsible adult.

By paying more than your minimum payment, you save a lot on interest charges.

7. Put It All On the Card

Once you’ve established a disciplined method for holding yourself accountable, and you have cut out unnecessary expenses, you can cut yourself some more slack. When you pay off your credit card in full every month without fail, you are showing the banks and the credit bureaus you are financially responsible

Start slow, but don’t be complacent. By paying off the entire balance every month, you are also showing that you are not living beyond your means. If you feel like you are drowning in debt, paying off more than you think you should will bring you more joy than buying that knick-knack you will never use again. Be smart. Be creative. And be the successful person you want to be.

8. Limitless

Bradley Cooper only learned one new skill in the movie “Limitless.” This skill was creativity. Being creative is what allows us to seize opportunities. Whether that means coming out of a ditch you’ve fell into or learning how to fly higher and faster. We are now in the Creative Age where creativity is the new currency. Raising your credit score will come from you being creative in ways that only you will know.

Be creative by cutting out meaningless purchases that you make on a day to day basis. By cutting out daily snacks, you could save $10 to $20 or more a week. Don’t try to impress everyone at the bar by buying rounds. The list of financial traps is extensive and by being aware of what they are, you will help yourself avoid them. Once aware, cultivate your creative muscle on ways to better improve how much money you pay yourself each time you receive a paycheck.

That $5 cappuccino every workday is really a $1200 expense every year. That puts things in perspective doesn’t it? You can do a lot with an extra $1200 dollars a year. Try to find as many needless expenses to cut out every day and every week and watch the savings pile up. Use your card for things that are important and bring you joy, rather than for debt that will bog you down.

9. Lend A Helping Hand

Young people are put in a unique situation with credit scores.

They have a hard time getting money lent to them because they usually haven’t raised their credit score. Parents and guardians can help with this. If you look after a young person, one way to increase their credit score is by allowing them to be associated with your credit card. In other words, your young adults can build their credit score by being authorized users on your credit card (sounds scary)…

If you are that young person, ask a trusted family member if they can help you out. Just make sure not to go crazy with the card, because both of your credit scores will be affected. Make sure they keep you accountable rather than be permissive so you can learn how to be a fiscally responsible adult. Think of how that debt could affect that trusted family member and limit it.

Final Words

Creativity is how you raise your credit score, come up with an idea for a new company, say a witty joke to make a girl smile. Creativity is the key to rising from the ashes.

People make a decision to change for one of two reasons: desperation or inspiration. Usually one chooses to increase their credit score out of desperation.

No one will loan me money, I need to raise my credit score!

If you’re making a lot of decisions out of desperation there’s no need to be hard on yourself, just notice it. Then begin to take small steps to make more decisions out of inspiration. This is the difference between moving towards where you want to go and moving away from where you don’t want to be. Small subtle, big difference.